Being a completely new style of vodka (using technology to extract the flavour of rosé wine) we conducted primary research on the brand. First, we worked out what we wanted to find out from the research to answer the brief and ensure we got accurate and actionable information we could use to inform both the brand and our launch strategy. We designed a questionnaire which covered topics such as competitors, their experience of the vodka market specific to their style of organisation, product positioning feedback, their decision making process on vodka and how the product could potentially be sold/served in their venues. At each point we were careful not to give leading answers and we deliberately kept the brand name, visuals and pricing anonymous until we were prepared to reveal it, so as not to influence respondents’ decisions. The questionnaire was sent out to some of our key customers across the hospitality sector to get a broad view of the market. Respondents were incentivised to complete the survey by being the first to receive a bottle once the product was available and by playing an integral part in a brand launch. In total we received 20 responses from hotels, cocktail bars, retailers and department stores. Some of these customers were:

- Claridges Hotel (5 Star Hotel)

- Le Manoir aux Quat’Saisons (5 Star Hotel)

- Hampton Manor (5 Star Hotel)

- Fortnum and Mason (Department Store)

- Nectar Imports (Wholesaler)

- Inception Group (Bar Group)

- Nightjar (Cocktail Bar)

- The Bottle Club (Online Retailer)

- Spirits Kiosk (Online Retailer)

- Tipples of Manchester (Independent Retailer)

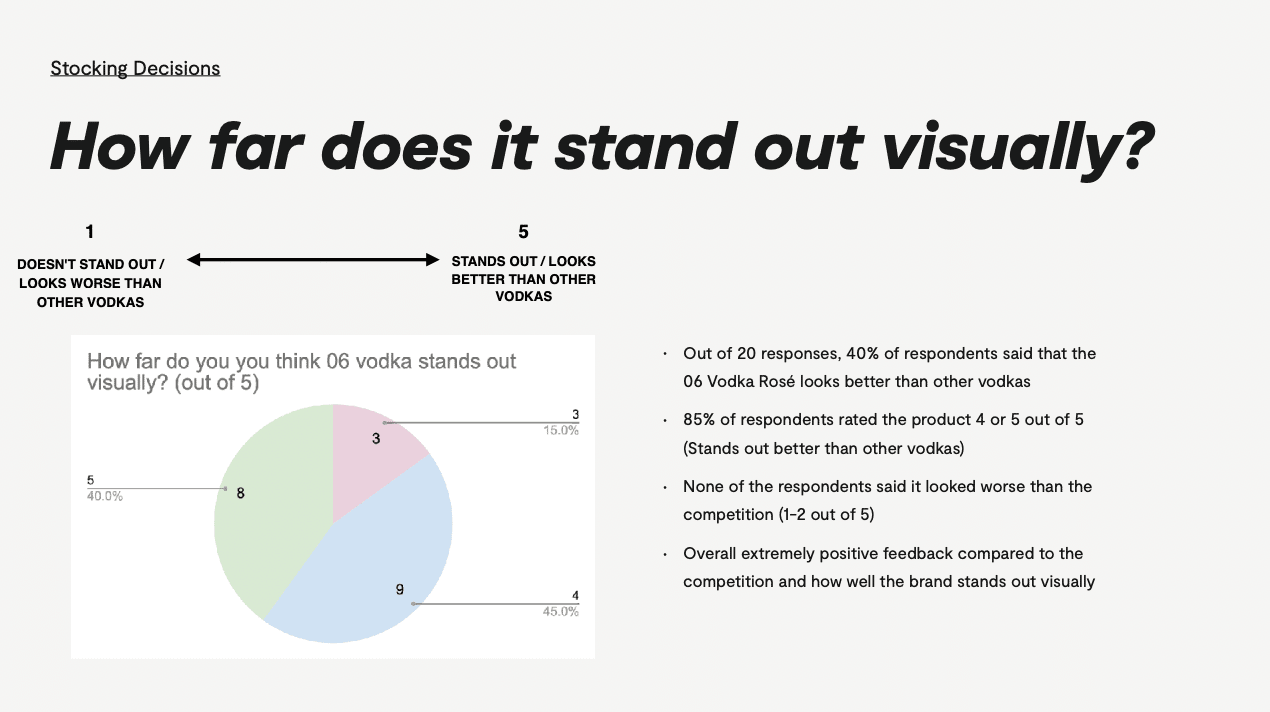

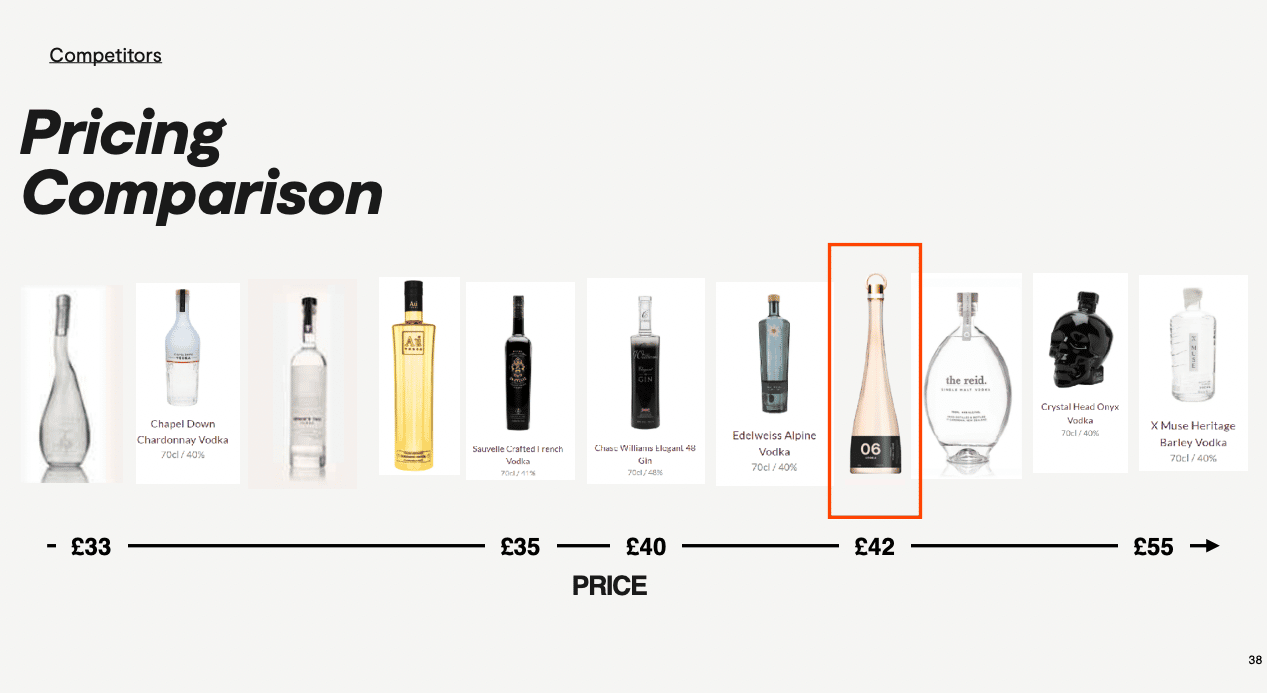

We also conducted pricing research. looking at competitors’ pricing in the vodka category to ensure the product was set up for success. With a wealth of research at our fingertips we interpreted the data into a comprehensive report for the brand. We split the feedback into digestible sections making recommendations along the way. These sections were; 1) The Competitor landscape, 2) Category Trends and Opportunities 3) Relevance and suitability depending on customer type, 4) Product specific feedback, 5) Pricing feedback, 6) What would be required to make the product a success. We then took these results and crafted a drink serve strategy and marketing strategy to maximise awareness and grow sales. We used the information to inform what support and marketing budgets we would require for a successful brand launch.